The rise and rise of Open Banking and Open Finance

- Grishma Valliyod

- December 17, 2021

Let’s talk about two buzzwords in the fintech space– Open Banking and Open Finance. To understand the scale and relevance of these words, we gathered some stats.

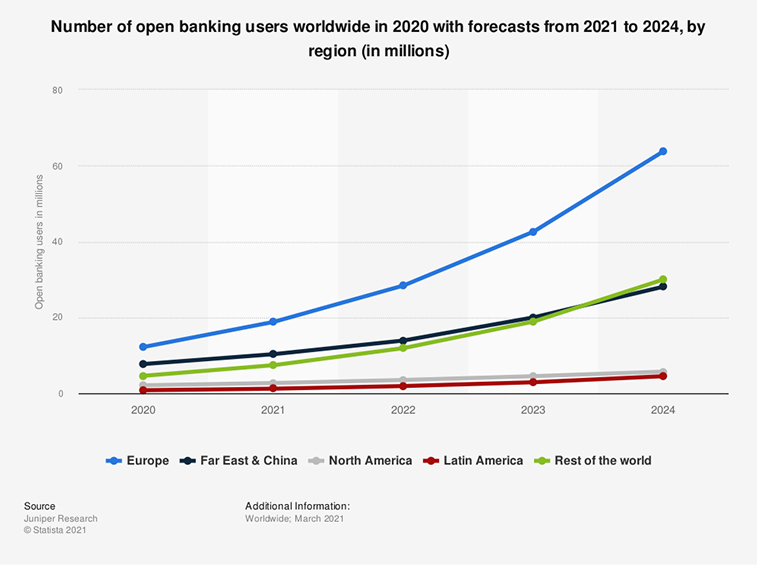

A survey by Statista showed that the number of open banking users worldwide is expected to grow at an average annual rate of nearly 50 percent between 2020 and 2024. And as of 2020, 24.7 million individuals worldwide used open banking services, a number that is forecast to reach 132.2 million by 2024.

Additionally, McKinsey did a study early this year with 259 open-banking licensed providers and open-banking innovations in the UK. The results showed that two-thirds of these innovations are products or services created by fintech companies or non-bank players and the remaining one-third were innovations offered by banks or building societies.

When we researched further about banks adopting APIs, we saw that there was a growth of nearly 19% between Q4 of 2019 and Q1 of 2020, according to Nordic APIs, and the Asia Pacific region saw the greatest ratio of API products to API banking platforms.

What is Open Banking?

Open banking is a practice that gives open access of financial information and data to third party financial service providers through Application Program Interfaces or APIs. The biggest advantage of open banking is that it moves away from the traditional centralized model and allows consumers, financial institutions, and third-party services providers to create a secure institutional network to access account information and financial data.

Open banking is a practice that gives open access of financial information and data to third party financial service providers through Application Program Interfaces or APIs. The biggest advantage of open banking is that it moves away from the traditional centralized model and allows consumers, financial institutions, and third-party services providers to create a secure institutional network to access account information and financial data.

To explain further, open banking allows regulated websites and apps to access transaction data from bank accounts and payment services so that you can ‘move, manage and make the most of your money’. For lenders, this means more visibility into a consumer’s financial standing. Borrowers, in turn, can have a better understanding of their own finances before taking a loan.

What is Open Finance?

Open Finance is the next step in the Open Banking journey. Financial data such as mortgages, savings, pensions, insurance and consumer credit – basically your entire financial footprint – could be opened up to trusted third party APIs if you give the access.

Open Finance is the next step in the Open Banking journey. Financial data such as mortgages, savings, pensions, insurance and consumer credit – basically your entire financial footprint – could be opened up to trusted third party APIs if you give the access.

So, open finance is basically expanding the open banking concept to more sources of data.

By sharing financial data with trusted third parties, customers could get better deals through tailored value-added products and services. It also gives better visibility and greater control over their data.

The end goal for Open Finance is improved financial health driven by market innovation and competition. The access to information is more secure and more real time for better decision making.

Benefits:

Open Banking is paving the way to the future of fintech and here is a summary of the benefits:

- Improved customer experience by personalization and advanced product offerings

- New revenue streams for Banks and Financial Institutions from untapped markets

- Enhanced KYC capabilities that increases security and reduces risk of default and fraud

- Competitive advantage through the ability to rapidly adopt and scale digital capabilities

- Increased collaboration between banks and fintech companies provide scope for future innovation.

By not adopting open banking, financial institutions are putting themselves at a risk from a regulatory standpoint added to the risk of not meeting customers' expectations and adapting to latest market trends.

By not adopting open banking, financial institutions are putting themselves at a risk from a regulatory standpoint added to the risk of not meeting customers' expectations and adapting to latest market trends.

We work on automation solutions leveraging Open Banking, for a lot of banks and financial institutions across the US and we see that Open Banking is the way forward.

At Lateetud, we make automation Intelligent. And Intelligent Automation has a large role to play in open banking digital transformation. To know how, talk to us at www.lateetud.com.

Categories

Most popular

- Data Extraction challenges from Semi-Structured & Unstructured data source and how to overcome it

- The Scope of Healthcare Automation in Telehealth and Telemedicine

- Transforming Enterprise Business Management with Cognitive Robotics Process Automation

- How to Build an Intelligent Automation Strategy

- Automation Potential in Claims Processing

- Role of RPA in Revolutionizing Revenue Cycle Management of Healthcare

- The 7 major pitfalls to be avoided when implementing Robotic Process Automation

- Everything you need to know about Agile Process Management Solutions